More well thought out work can be found at — https://axial.substack.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

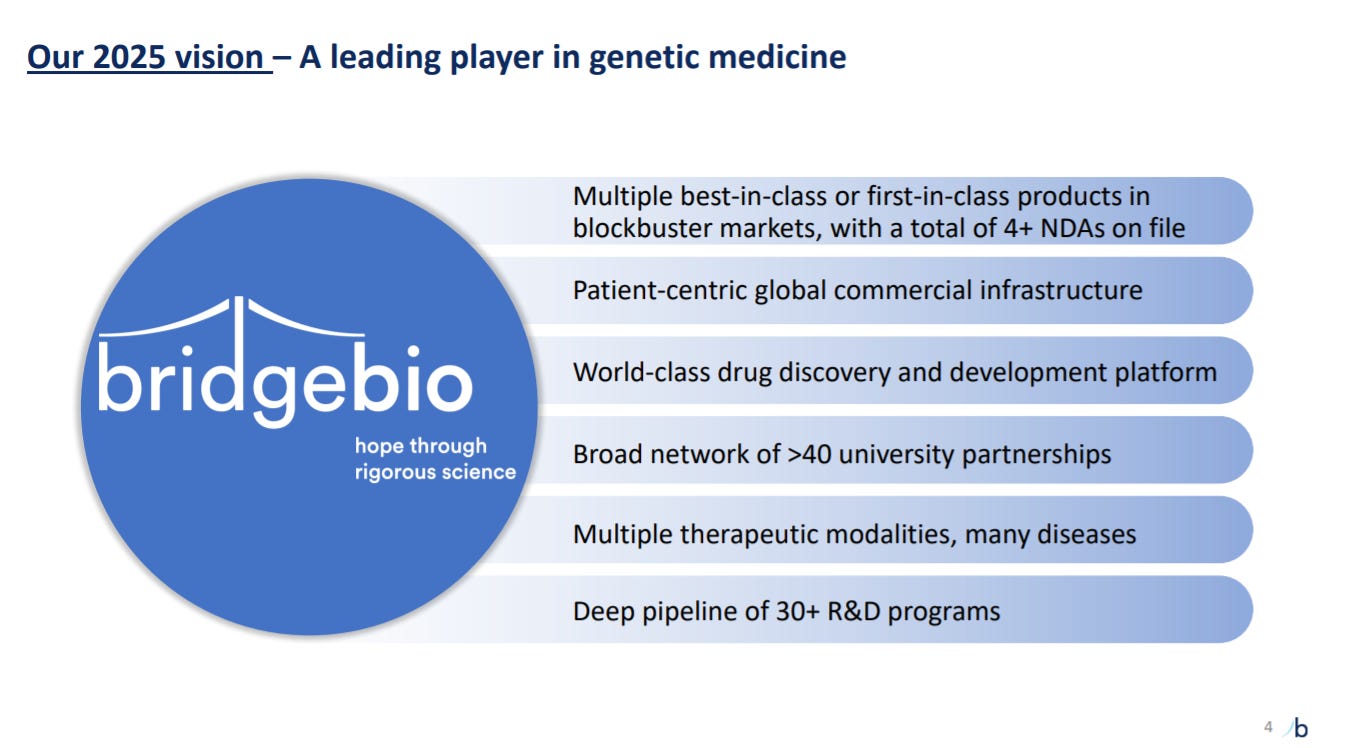

Neil Kumar is the Co-founder and CEO of BridgeBio, one of the most unique businesses in life sciences. Before starting the company, he was a principal at Third Rock Ventures where we served as the interim vice president of business development at MyoKardia. He also worked at McKinsey and was trained as a chemical engineer at MIT for his PhD.

1.“I think when you start pitching in biotech, it’s within a concentric circle of people who generally fund biotech. The obvious problem is most of those people are looking like a certain type of person, like a 30-year veteran from Novartis backed by Flagship, or backed by Arch, and we didn’t fit any of those criteria. In retrospect, to be rejected is not all that surprising. We started to get more traction when we were pitching people not necessarily in that sphere.”

2. “It feels like it’s way better—there are more people and more different thinking. When we started, we didn’t have any titles or an organizational structure. Like certain species of animals solve problems as swarms, we saw our company as a swarm. A swarm of three people is not that effective. A swarm of 350 people can be pretty damn effective. It’s the same culture of intense problem-solving, questioning stuff, chip on your shoulder, 'patients-first' mentality, but we can then apply it to a lot more.”

3.“If we are not successful on a majority of those, the thesis that we are good asset pickers and therefore our ability to prosecute on everything else will be challenged, it will be.”

4.“We kind of think of it as a top-down married with a bottom-up model. We are constantly monitoring a suite of about 7,000 Mendelian or monogenic diseases. [When there is a clear blueprint of what happens in a gene and what symptoms that causes in patients], this is when a disease becomes of interest to us That’s the bottom-up part.”

5. “Initial growth, well, it makes sense for any company. Going from zero to one or two is what anyone will do. Market access, patient hub services, disease awareness strategies, diagnostic partnerships—typical in our field—educating physicians to find patients, helping patients navigate their disease better and, ultimately, make sure people across the US, EU and worldwide have access to our drugs. Those are the things that should be centralized, and they’re all things we’ve been building out”

6. “[We] didn't see anyone else doing it (with regards to business model innovation in biotech), so we're doing it [a new] way.”

7.“The area we play in is the least risky of the R&D universe. The number of bets we need to take to ensure a lottery ticket isn’t all that high, though our lottery tickets are a lot less lucrative. In neurodegenerative and neuropsychiatric diseases, the risk is much greater. We understand them less well. But the lottery ticket could be huge.”

8. “There was a time in which we couldn’t really afford what we needed to do clinically. Since then, BridgeBio’s been able to evolve as a company so that we have more and more resources, whereby we thought the reverse would be true, and bringing it back inside fully would allow the Eidos team to do even more.”