Axial - Observations #47

Life sciences reflections

More well thought out work can be found at — https://axial.substack.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Observations #47

A set of ideas and observations from a week’s worth of work analyzing businesses and technologies.

Fast following in drug development

There is a large opportunity to develop new business models to be a fast follower in drug development. Many branded drugs often have consistent price increases (over 10% annually) over the lifetime of its patent exclusivity without any underlying improvements. This creates a market opportunity for other companies to fast follow on the branded drug and undercut on price by up to ~50%. Many biotechnology companies in China and EQRx are leading the way. The idea is to bring a Southwest Airlines or Danaher business model to drug development. Companies in China have been able to do this at least in their home country mainly due to labor advantages and regulatory monopolies. EQRx boldly got started to do something similar in the US and do fast-following more systematically.

To successfully have a shot at building an enduring business around a fast following model are few things are needed:

Having an ability to design patent-breaking drugs

Also, having the ability to execute more efficient clinical trials. A fast follower has to get to market before the branded drug goes generic. This probably means that the company has to initiate a program before a branded drug is actually approved. A company has to build forecasting tools to not only predict their success but the success of the branded drug in trials.

Pursuing only established targets and mechanisms, which hopefully lead to lower clinical failures for the fast follower. This is also enabled by the increasing power of genomics over the last 2-3 decades; target discovery has been commoditized already.

Identifying markets where the fast follower model can expand the market or get a higher share (figure below from EQRx). If the fast follower is charging lower prices, there is a possibility that more patients, and their plans, can afford it. Other elements like competition, reimbursement, and market uptake are important here.

Establishing strong payor relationships to ensure patient access and quick market uptake

Ultimately, this model has the potential to commoditize some parts of drug development. For diseases with established targets and mechanisms, a company could build moats around commercialization, capital structure, and forecasting rather than discovery. This model is fraught with risks. Clinical trials are probably going to fail - is a company capitalized well enough to weather this? Executing faster trials is still hard even for validated targets. Patent issues can arise from this model. Incumbents will fight back - biopharma will use vouchers to shift who pays their high prices, a PBM could exclude the fast follower from their formulary, and more.

The fast follower model also has the potential to be one of the first drug companies to actually delight their customers. So who could they be?:

Patients - building a brand around lower pricing and increased access

Drug companies - a source of licensing opportunities for the fast follower. A straightforward strategy is to bring assets from China to the US.

Payors - probably the most important relationship to help the fast follower lock in purchases of their drug and market access

Networks - hospitals in particular help the fast follower more easily recruit patients and run more efficient clinical trials

Physicians - in the fast of the large sales forces of incumbents, fast followers need to show non-inferiority and get payor help here

PBMs - with recent consolidation of pharmacy benefit managers (PBM), a fast follower could try to find a way to reward them or bypass them completely. PBMs are probably the stakeholder to focus on the least

Source: EQRx

Single-cell sequencing

Single-cell sequencing, led by tools developed by 10X Genomics, are enabling many new avenues in research and applications in drug development and diagnostics. Up to millions of cells can be manipulated and profiled to measure their heterogeneity and individual gene expression. The human genome has around 30K genes that produce over 100K mRNAs (splicing creates more variants). Each cell expresses around 10K genes with a few thousand having cell-specific patterns.

In 2003, the Human Genome Project was completed enabling new applications in particular genome-wide association studies (GWAS). The goal of this work was to build a database of genetic variants and link them to different phenotypes and disease. Due to the underlying complexity of biology, GWAS never fulfilled the promise of genomics. Large-scale sequencing efforts driven by the super-exponential decrease in costs and Illumina, helped increase access to data and scale up this work. The next step has been sequencing single cells to understand cell-to-cell variation, not just human-to-human, and their genomes, epigenomes, transcriptomes and proteomes. New tools are needed.

Beyond single-cell sequencing, we are moving toward perturbing biological systems to measure changes within them. A catalog of genetic parts are being discovered, which is setting up for large-scale perturbation studies of single-cells. Coral Genomics is a leader here. This work could finally fulfill the original vision of the Human Genome Project: linking genetic variants to different traits and diseases.

What are some of the important problems to solve in single-cell sequencing?:

Integrate new single-cell measurements and standardizing them between samples: DNA, RNA, proteins, methylation, chromatin accessibility, spatial arrangement

Increasing sorting throughput/efficiency in single-cell sequencing. This would lead to gains in resolution and the number of cells profiled. In some situations, due to these limitations only a few 100 cells can be measured. This would increase the number of cell types we discover along with their developmental trajectories.

Better analysis and visualization tools to analyze higher dimensional data - a higher number of numbers or data measurements per cell. It seems there is a Something-seq paper every day, and this work has created a tremendous amount of data. Sometimes the data is pretty noisy due to low capture rates, batch effects, PCR biases, and more. Moreover, better tools to automate cell-type annotation are needed.

Single-cell sequencing is now building a parts list of individual cells. Whereas we had a parts list for individual humans but not did not fully recapitulate the complexity of biology. Single-cell probably doesn’t create a full picture by itself, but it is a major step forward in understanding biology and disease. The human kidney, interactions between immune cells and antigens, tumor microenvironments have been more accurately profiled because of these tools. With a better mechanistic understanding, we have a better shot at creating better medicines and products for human health.

In short, the main question in single-cell sequencing is - what does 10X enable? The company is in an incredible market position and would be hard to usurp. As a result, new companies can think through new applications in oncology, autoimmunity, neurodegeneration, and more to build on top of. New immune cell profiling companies are springing up to find new mechanisms to pursue in immuno-oncology and autoimmunity. 23andMe could ever start integrating single-cell sequencing to their product line. New diagnostics can be created along with more accurate organoid models. Finding new insights from the spatial arrangements within cells is a new frontier. GWAS showed the power of new data helping generate better hypotheses. Single-cell sequencing is some orders of magnitudes better in terms of scale and resolution. With this new data, inventors and founders should be able to ask better questions to understand biology and disease.

Building the US-version of WuXi

Driven by the theme of onshoring biomanufacturing, it is imperative that a US-version of WuXi is built. Resilience has a shot, but so many more companies need to emerge to take advantage of the opportunity and reinvent the CRO. WuXi was founded by Ge Li in 2000 as a services company for synthetic chemistry. Each and every year the company rolled out a new offering: manufacturing, bioanalysis, formulation, AMDET. Charles Rivers Laboratories had the opportunity to buy WuXi in 2010 but ended up nixing the deal. Over the following decade, WuXi grew into one of the largest and most innovative contract-research organizations (CRO) in the world and positioned itself to dominate discovery services globally.

WuXi has been able to win for 6 key reasons:

Labor arbitrage - being in China gives WuXi access to a large amount of talent at much lower wages

Scale - Wuxi has a suite of services done at large-scale built over 2 decades. The company offers services for a wide range of modalities from small molecules to biologics and cell/gene therapies. They provide discovery, development, and manufacturing services and even offer things like medical device testing and genomics products.

Flexible deal structures - WuXi has been flexible in the terms it provides to its customers. The company offers fee-for-service contracts with various milestones and royalties on some of the products if appropriate. Beyond services, WuXi is also aggressive with joint ventures and investing.

Founder-driven company - Ge Li still runs the company and is motivated to complete his vision

Regulation - if a company outside of China wants to bring a drug, especially biologics, to China, they must meet regulatory requirements by repeating the development and manufacturing process in China again. This is a lucrative business for WuXi.

Standardization - WuXi gets lock-in by getting customers early and fully-integrating from discovery to manufacturing

These 6 drivers enabled WuXi to dominate services from discovery to development and finally to manufacturing. Now WuXi has set its sight on internal product development. The first example of this was WuXi spinning off its biologics manufacturing business into WuXi Biologics in 2015. This gives a glimpse into the future for WuXi in cell and gene therapies and beyond. WuXi Biologics focuses on fully integrating services for biologics drug development: (1) drug discovery, (2), pre-clinical work, (3) phase 1/2 clinical development, (4) services for pivotal studies, (5) commercial manufacturing. This end-to-end platform allows any customer to plug into WuXi but more importantly makes biologics development a lot more accessible. For WuXi Biologics, it’s probably more valuable that they get companies as early as possible because they will spend increasingly higher amounts as the research and trials progresses. Because WuXi Biologics is such an essential component for smaller companies with less resources and larger ones that want access to the Chinese market, the company has been able to get royalties on some of the products produced from their services and are set up to build an internal pipeline.

It seems obvious that WuXi has the potential to take control of the global CRO market. With such a dominant position, there is a need to build a US-version. The end-state is easy to comprehend - it’s WuXi. But what are good first moves?:

Focusing on higher value products like cell and gene therapies

Building technology-enabled services that can take on WuXi’s labor advantages

Rolling up services to become fully-integrated at least for a region or specific area then expanding

Immunometabolism

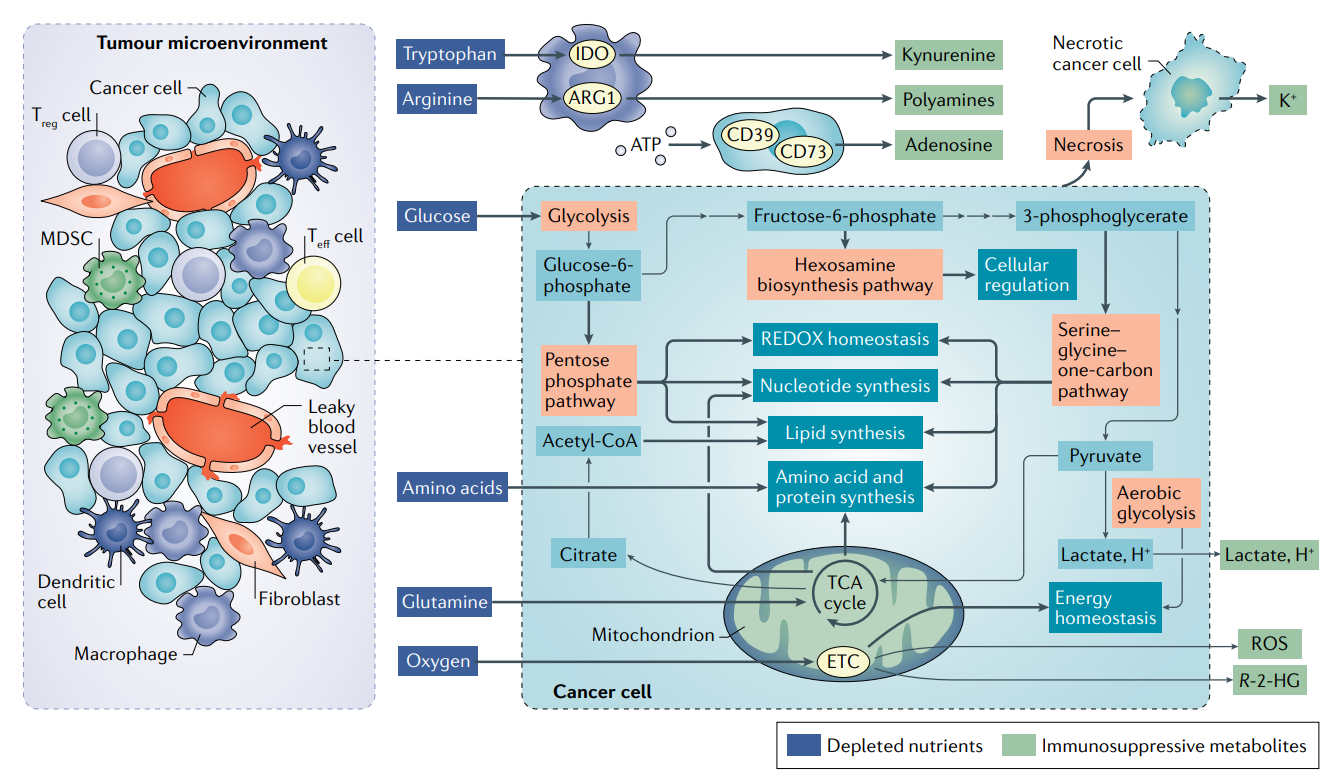

Metabolism creates a set of diverse tumor microenvironments (TME) across cancers and patients. Importantly, metabolism within each TME has a significant effect on immune cell function and the ability for immunotherapies and cell therapies to treat solid tumors. Particularly, immune and cancer cells actually converge on their metabolic pathways competing for the same resources to grow. This creates an environment to inhibit immune cells in the TME but also an opportunity to target metabolism to help immune cells kill cancer cells.

Companies like Agios (targeting IDO) have been built on the premise of targeting metabolism to treat cancer. However, the full potential of the field is still to be realized mainly due to the diversity of immune cells within the TME and the unique role of oxidative phosphorylation and glycolysis along with other pathways in immunometabolism.

Immunometabolism is such a complex field. Immunology is already hard enough. Adding metabolism on top of it only makes figuring out cause/effect relationships even more difficult. Opportunities in the field are:

Measuring the metabolism difference between a given tumor and immune cells in the TME

Metabolic requirements for each immune effect cell

Using this information to find weak spots in metabolism to pursue and develop new medicines. The hard part here is the differences might be so slight that therapeutic windows could be very narrow.

History of oligonucleotides

Useful history on RNA interference and the technologies translation into medicines - https://www.oligotherapeutics.org/20th-anniversary-of-rna-interference-in-mammalian-cells/