Axial - Observations #27

Life sciences reflections

More well thought out work can be found at — https://axial.substack.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Observations #27

A set of ideas and observations from a week’s worth of work analyzing businesses and technologies.

Biosimilars in emerging markets

Biosimilars are generic biologics. Due to complex manufacturing, regulations, and IP barriers, biosimilars haven’t experienced a lot of success in the US. They’ve done pretty well in Europe; in some European countries biosimilars have over 50% market penetration. However, emerging markets like China, South Africa, Indonesia, and India seem to be prime countries for new biosimilar companies to quickly take up market share and bring generic biologics from the US to their country.

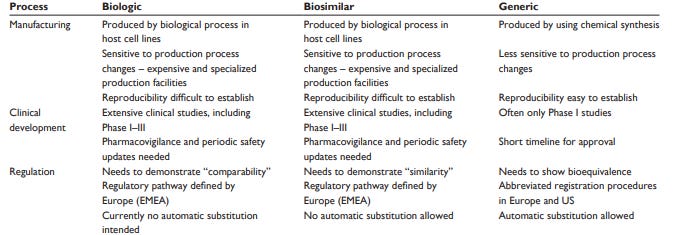

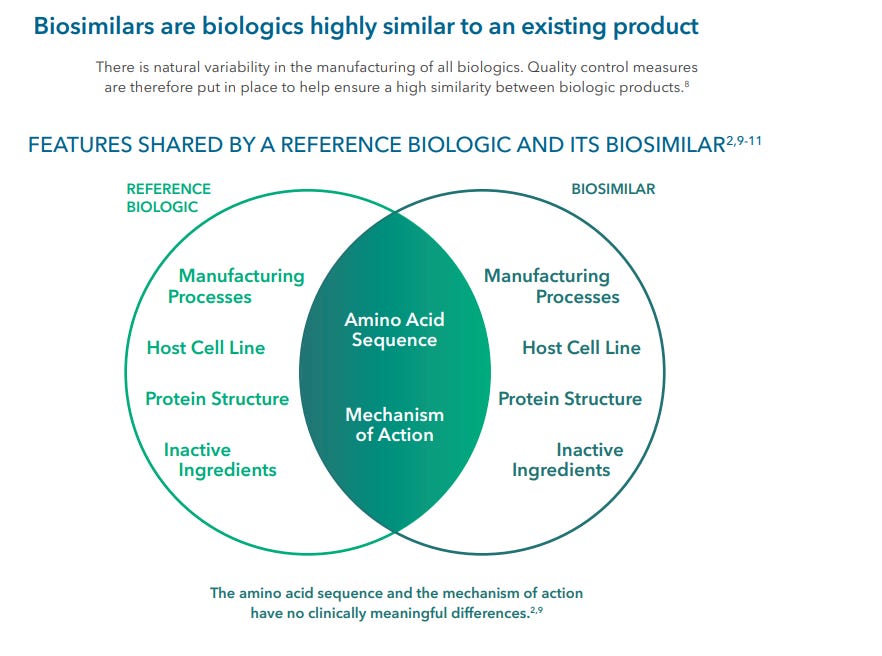

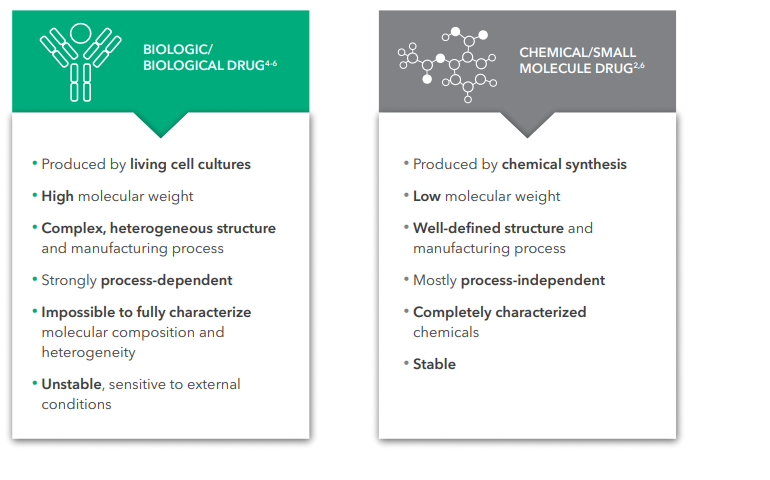

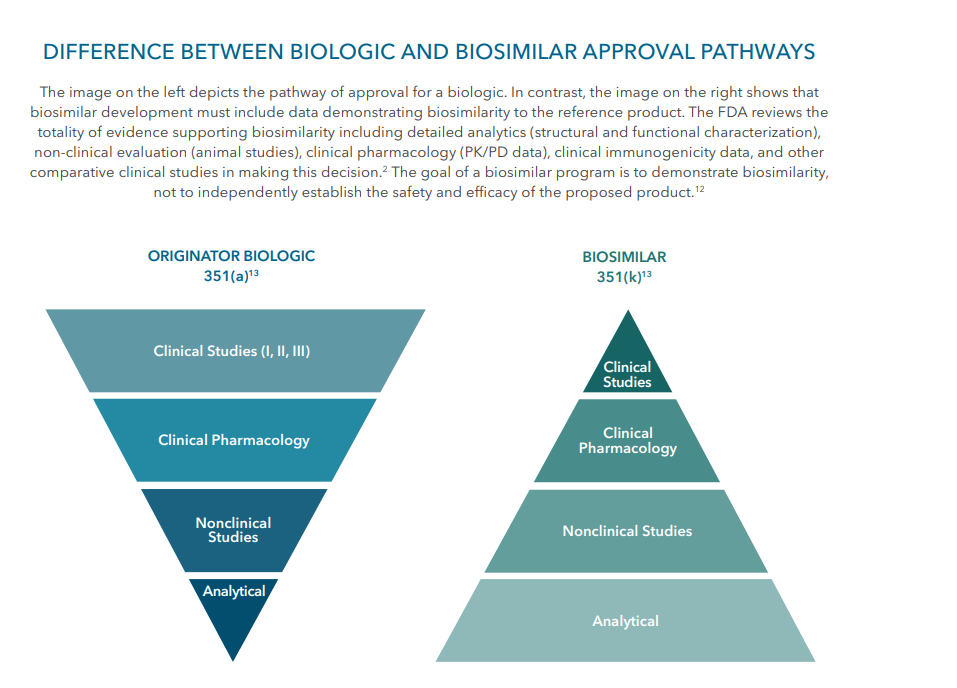

The process to produce a generic biologic is far more complex than creating a generic small molecule drug. Biologics are manufactured by cells, which are a lot more variable than chemical synthesis. Unlike generic small molecules, it is impossible to generate a biosimilar that is identical to a biologic (incumbents don’t share their manufacturing protocols). Biosimilars may not be identical like generic pharmaceuticals, but are similar to the branded biologics based on effects.

Europe was the first to approve a biosimilar (generic HGH) in 2006. There are now over 40 biosimilars approved in Europe and over 20 in the US. Uptake of biosimilars hasn’t been as successful as expected. However, branded biologics are putting a large financial strain on the healthcare systems of emerging countries. Moreover, these countries currently are reliant on foreign manufacturing of branded biologics. These two features are creating a unique opportunity for new biosimilar companies to reduce the cost of biologics in their respective market and onshore production. Actually, building a biosimilar market in a country outside the US, Japan, or Europe has a few advantages:

Cheaper cost of goods and lower labor costs

Large domestic markets that are often underserved

Lower regulatory hurdles and actually might get a lot of support from local governments

Less competition

Not only will patients in these countries gain access to much needed medicines, but the biosimilar market could actually successfully scale in a market outside the US, Japan, or Europe, something that hasn’t really happened over the last decade.

China has been the epicenter of building a domestic biosimilar company. In China, branded drugs are often paid out-of-pocket and the government has pushed to lower regulatory and IP requirements to create what they call “copy biologics.” Well over 100 of these copy biologics have been approved in China much larger than the combined number of the US and Europe. Incumbents have recognized this market dynamic and some have jumped in to preserve some of their biologic/biosimilar revenue. In 2017, Amgen formed a strategic partnership with Simcere to co-develop and commercialize biosimilars in China. In 2018, Alvotech formed a joint venture with Changchun High & New Technology Industries Group to develop, manufacture and commercialize its biosimilar portfolio in China. As the largest market in terms of patient numbers, China (Indie is here too) is setting the regulatory and commercial framework for biosimilars outside the US, Japan, and EU. Domestic Chinese companies like WuXi and Gan & Lee grew their capabilities and business focusing on biosimilars. Then these companies used their expertise in scale-up, manufacturing, process development, and other methods to export their growing pipeline of biosimilars and branded drugs abroad. So the US, Japan, and EU have been used to create reference products for companies in other markets to make generic versions of.

In the early 2000s, large biotech companies faced the pending patent expirations of their blockbuster biologics. They have two main choices:

Let the patents expire and focused on building a new pipeline of branded medicines

Continue the growth of its current drug portfolio by entering emerging markets

Many large companies chose the first route, which has opened a still large window for new companies like WuXi to go through. Large incumbents in biotech don’t really want to develop generics and biologics even off-patent maintain exclusivity due to the technical barriers for entry (i.e. process is the product). These companies did not have a clear pathway for biosimilars until 2009. The off-patent exclusivity in biologics is the most important thing that enables new companies to create biosimilars in emerging markets. So what are the big business opportunities for biosimilar companies in emerging markets?:

Build a biosimilars business in an emerging market to provide to building blocks for something larger in a proprietary pipeline of biologic

Going beyond CHO-based expression platforms. Maybe plant-based systems.

Pioneering the use of micro-scale and continuous manufacturing.

Could lessons learned in the biosimilar market in emerging markets be transferred to the US to build a fast follower drug business model?

Help large biopharma companies in the US actually diversify their pipeline and R&D work. Biosimilars have lower R&D risks and might have larger commercial potential in emerging markets versus developed ones.

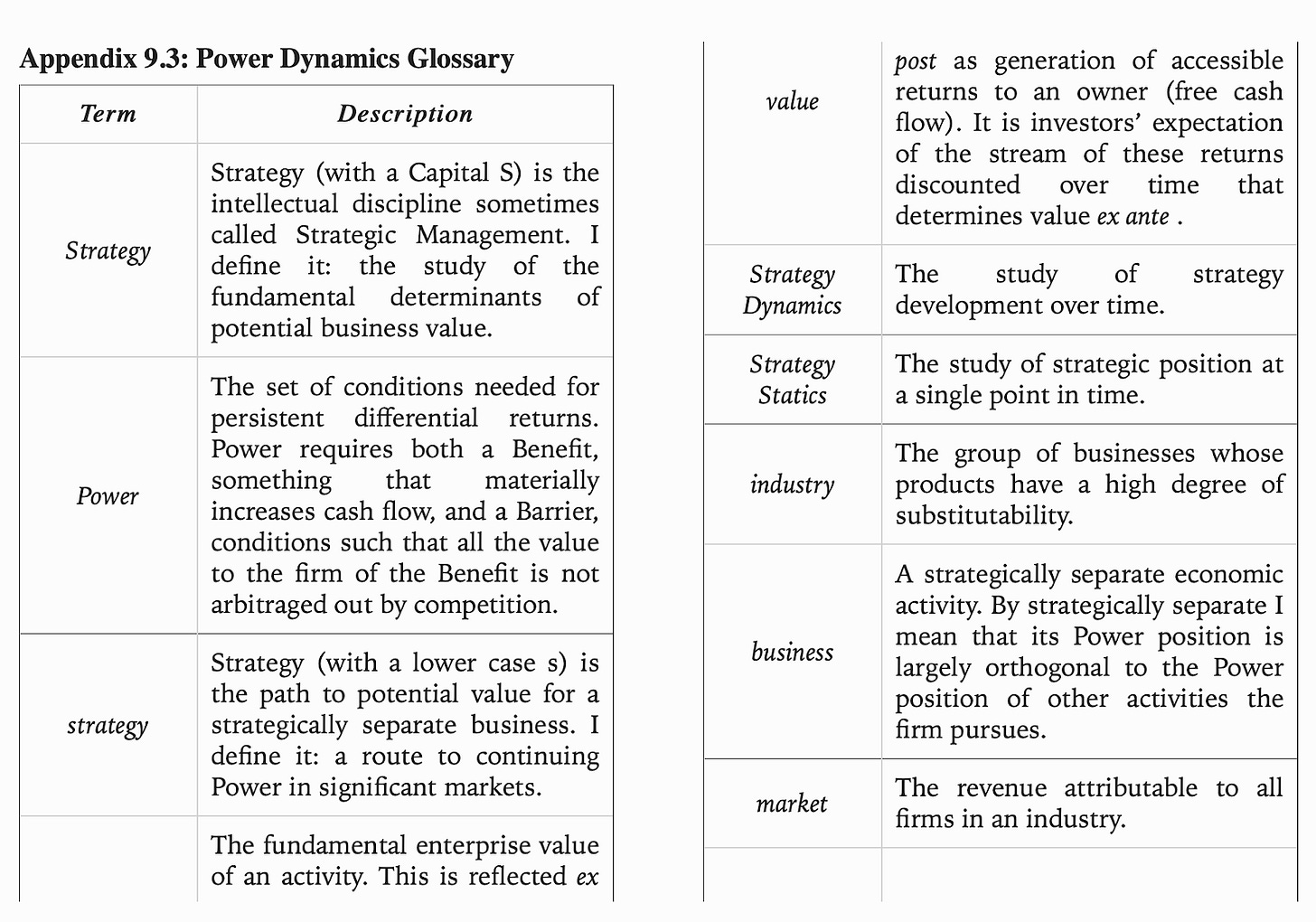

7 Powers

A really useful book for business strategy is 7 Powers: The Foundations of Business Strategy by Hamilton Helmer. The book lays out 7 features of a successful strategy and uses various case studies to support the framework - scale economies, network economies, counter-positioning, switching costs, branding, cornered resource, process power:

Scale Economies: as production volume increases, the per unit cost of a product decreases. This allows a company to actually create more consumer surplus over time because the fixed cost per user goes down with scale. Companies like Walmart use scale economies to get better supplier deals, Netflix to lower its price for content, Intel to get better manufacturing deals, and Amazon to have lower distribution costs.

Network Economies: the value of the product increases as new users join. This dynamic creates winner-take-all markets. Examples are social networks like Facebook and LinkedIn. The benefits of network economics are twofold - the value of the network imbues pricing power to the company that wields it and makes the costs too high for new entrants to even start gaining market share.

Counter-Positioning: pursuing a business model that would damage an incumbent. New inventions are useful here with Kodak and digital images as an example. Five Guys versus McDonalds is an example of counter-positioning brands. And Netflix as one for distribution. This is a powerful strategy for a startup because biases or fear could delay an incumbent’s action and provide time for the former to gain market share. Five stages of counter positioning: (1) Denial (2) Ridicule (3) Fear (4) Anger (5) Capitulation.

Switching Costs: the loss a customer would experience from switching from one product to another. Oracle for databases is an example. Microsoft for operating systems. This power is very useful to sell a customer additional services but does not help to acquire new ones. The three types: (1) Financial - money invested (2) Procedural - time to learn how to use the product (3) Relational - personal relationships.

Branding: attributing higher value to an identical product often derived from the product’s past track record of use. Coke is an example. Strong branding creates a positive feedback loop by reinforcing buying.

Cornered Resources: having access to a scarce resource. This could be a new invention, trade secrets, a regulatory exemption or license, or something else hidden. Examples are Genentech and Pixar.

Process Power: when institutional knowledge creates a more production company. Examples are Toyota and Danaher.

Neurotechnology

Neuroprosthetics and brain-computer interfaces are set up to transform patient lives and possibly redefine what it is to be human. However, the brain is pretty complex and our understanding of fundamental neuroscience has been/is the barrier to bring neurotechnology to patients. If we have to rely on having a deeper understanding of the brain before we can bring these products to patients, it might take decades to get there. So what from medical history could be useful to understand how to properly commercialize neurotechnology?

Vaccines have been around for a couple centuries well before we know much about our immune system. The key lesson here for neurotechnology from the history of vaccines is to actually focus on safety for all rather than maximizing efficacy. If you don’t understand something and it goes wrong, it will get bad pretty quickly. So you want to avoid that.

The key driver for the success of neurotechnology will actually be a long track record of safety instead of the amazing effects. This will not only help with GTM for neurotechnology but also use - simply, clinicians are comfortable with implanting devices in a patient’s brain that have long safety track records. A useful example are cochlear implants that convert sound into signals sent to the brain - a little over 300K of these devices have been implanted. Well over 150K deep brain stimulation (DBS) devices have been implanted. Excitedly, the procedures for DBS devices versus BCIs is in the same ballpark of invasiveness. This really bodes well for the future of the field and patients with memory loss, paralysis, and pain.