Axial - Observations #25

Life sciences reflections

More well thought out work can be found at — https://axial.substack.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Observations #25

A set of ideas and observations from a week’s worth of work analyzing businesses and technologies.

GoodRx

GoodRx filed for a $100M IPO - https://www.sec.gov/Archives/edgar/data/1809519/000119312520234662/d949310ds1.htm

With earnings above $100M and a profit margin of 17% and EBITDA margin of 40%, GoodRx has built an incredible business enabled by the opaque pricing of drugs in the US. The business works by:

Pharmacy having a certain drug price derived from biopharma companies and wholesales

Having a customer go to GoodRx to find discounts on drugs

Customer buys the drug with the GoodRx coupon at the pharmacy

Pharmacy pays pharmacy benefit managers (PBM), which gives a cut to GoodRx. Well over $300M is generated for GoodRx through this process. PBMs are willing to do this because they earn rebates from biopharma companies, which pay this money out to make sure their drugs are kept on the formularies.

This is all enabled by the convoluted way drugs are priced in the US. Pharmacies and biopharma are incentivized to set prices high to ensure PBMs pay for their drugs on a reasonable level with discounts and rebates included. With higher drug prices, insurers can increase plan premiums over time. PBMs want to earn more rebates. Ironically, the patient might get lower drug prices but the discounts do not count toward their annual deductible for health insurance. GoodRx has built a business to take advantage of the inefficiencies in the drug pricing supply chain and build a discount product to attract an increasing number of patients. This starting point is create a cross-sided network effects that will likely keep GoodRx deeply rooted in the US healthcare system for a long time:

Patients and the pharmacies: pharmacies want to bring more volume to their storefronts and patients want lower drug prices. So the former accepts GoodRx to get more consumers and the latter uses GoodRx to find lower prices. Pharmacies often get higher margins on generics versus branded drugs. GoodRx also improves the rate by which a patient actually picks up their prescriptions; this lowers the cost of inventory for pharmacies.

Pharmacies and PBMs: with more pharmacies accepting GoodRx, PBMs are happy to provide a cut of their fee with GoodRx. With insurers vertically integrating and generally consolidating, PBMs want to maintain their pricing power on drugs and GoodRx provides them the patient flow to remain competitive.

PBMs and patients: with more PBMs partnering with GoodRx, their product gets more clarity on the opaque pricing of drugs

Cell sorting

What can the combination of computer vision and image-based cell sorting create? What types of medicines can be reimagined?

Flow-cytometry cell sorting was invented ~50 years ago to physically isolate cells based on surface markers with the tool transforming life sciences in particular immunology. With flow-cytometry creating so much value with 1D measurement, what progress could be achieved if cells are sorted based on 2D images?

Breakthroughs in microfluidics, optics, and computer vision are just now making sorting cells based on images possible. This could enable to more easily sort cells on intracellular markers, spatial expression profiles, cell-cell interactions, and morphological features. Bottlenecks are around throughput and sample type. If you’re working on this, please reach out.

This evolution in cell sorting will have a major impact:

CAR-T

HSC medicines

Maternal embryo characterization/transplants

What else?

Kidney disease

In the US, kidney diseases affect an estimated 37M people and account for over $100B in annual costs. New tools in genomics have the potential to enable more precise medicines to treat diseases like chronic kidney disease (CKD) and other rare kidney disorders that often come with defined clinical development pathways. Which inventors or founders are working to build enduring businesses solving kidney disease?

So what tools would these individuals have at their disposal:

GWAS: used to discover new genetic variants of kidney diseases to reveal new pathways and MoA that potentially represent the targets for therapeutic interventions - https://pubmed.ncbi.nlm.nih.gov/22143329/

Proteomics: majority of urinary proteins are generated by the kidney and hold substantial information on renal pathogenesis. These types of tools might ultimately create tests that replace the traditional kidney biopsy. The CKD273 classifier, based on 273 urinary peptides, was well suited for the early detection of CKD and prognosis of progression - https://pubmed.ncbi.nlm.nih.gov/23690958/

Metabolomics: compared with other omics technologies, there are fewer metabolites (3 × 10^3) than there are genes (2 × 10^4), transcripts (>10^6), proteins (>10^6), and posttranslational modified proteins (>10^7). Increases in γ-butyrobetaine, citrulline, symmetric dimethylarginine, and kynurenine as well as a decrease in azelaic acid (β-oxidation) indicated the progression from mirco-DN to macro-DN - https://pubmed.ncbi.nlm.nih.gov/23052862/

Chemical probes

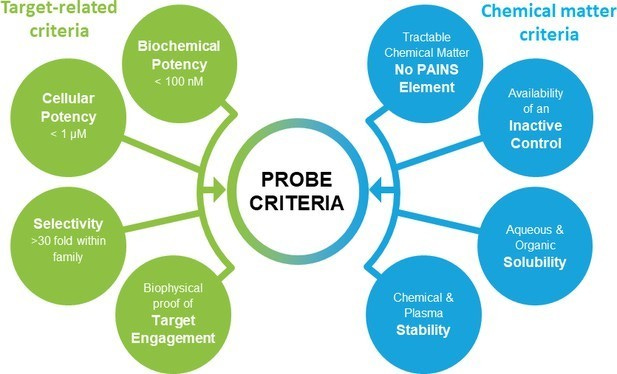

Researchers need tools to perturb biological systems. Think things like CRISPR, genetic knockouts, and in particular small molecule chemical probes. These probes are incredibly useful to reduce the activity of specific targets with temporal and spatial control; although, they might not be used as drug leads but as a tool to study and validate targets. However, the quality of probes for a given disease target can lead to false positives. What are the set of rules to choose a chemical probe that can ultimately be used to validate a drug target and study its function?:

Molecular profile - in vitro potency and selectivity

MoA - affecting the function of the target in a dose-dependent way

Identity of active species - chemical/physical properties of the probe and how they lead to MoA and its profile

Probe activity - cellular data of target engagement

A case study on the utility of chemical probes is out of the Pollard Lab at Yale to use probes to perturb Arp2/3 and study actin filaments. The group discovered two small molecule probes that inhibit Arp2/3. The probes have modest potency with half-maximal inhibitory concentration values of 10–30 µM, but the group used a suite of tests to validate the probes’ ability to bind/inhibit the targets:

Use of probe analogs as controls

Cell-free functional assays

Cell-based assays to verify probe activity

Cocrystal studies to explain structure-activity relationships and mechanism of action (MoA)

These tools are incredibly powerful to perturb pathways important in diseases like cancer and neurodegeneration. Importantly, chemical probes provide a drug developer and researcher temporal and spatial control of a target versus say a genetic KO. Beyond traditional protein targets, using probes to profile RNA, glycans, metals, and other targets will serve as starting points for entirely new classes of medicines.